How To Do Your Own Taxes

Filing your own federal income tax return may seem daunting at first, but with a bit of preparation and guidance, it can be a manageable task.

Filing your own federal income tax return may seem daunting at first, but with a bit of preparation and guidance, it can be a manageable task.

In this comprehensive guide, we'll walk through the steps involved in filing your federal income tax return, covering everything from gathering necessary documents to submitting your return. By following these steps, you can ensure that your taxes are filed accurately and on time.

**Step 1: Gather Your Documents**

Before you begin preparing your tax return, it's essential to gather all the necessary documents. These may include:

1. **W-2 Forms:** These forms report your wages and tax withholding from employment.

2. **1099 Forms:** If you received income from sources other than employment, such as freelance work or investment income, you'll likely receive 1099 forms detailing this income.

3. **Interest and Dividend Statements:** If you earned interest from a bank account or dividends from investments, you'll receive statements documenting this income.

4. **Receipts for Deductions:** If you plan to itemize deductions, gather receipts for expenses such as medical expenses, charitable contributions, and unreimbursed business expenses.

5. **Records of Estimated Tax Payments:** If you made estimated tax payments throughout the year, have records of these payments available.

**Step 2: Choose Your Filing Method**

You have several options for filing your federal income tax return:

1. **File Online:** Many taxpayers choose to file their taxes online using tax preparation software or through the IRS Free File program. Online filing can be convenient and may help you avoid errors.

2. **File by Mail:** If you prefer to file a paper return, you can download the necessary forms from the IRS website and mail them to the appropriate address. Keep in mind that filing by mail may take longer to process.

**Step 3: Determine Your Filing Status**

Your filing status (e.g., single, married filing jointly, married filing separately, head of household) will affect your tax rate and eligibility for certain deductions and credits. Choose the filing status that best reflects your situation.

**Step 4: Calculate Your Income**

Next, calculate your total income for the year. This includes wages, salary, tips, self-employment income, interest, dividends, and any other sources of income.

**Step 5: Claim Your Deductions and Credits**

Deductions and credits can help reduce your taxable income and lower your tax bill. Common deductions and credits include:

1. **Standard Deduction:** If you don't itemize deductions, you can claim the standard deduction, which is a flat amount based on your filing status.

2. **Itemized Deductions:** If your deductible expenses exceed the standard deduction amount, you may choose to itemize deductions instead. Common deductible expenses include mortgage interest, state and local taxes, medical expenses, and charitable contributions.

3. **Tax Credits:** Tax credits directly reduce your tax liability and can be more valuable than deductions. Common tax credits include the Earned Income Tax Credit, Child Tax Credit, and Education Credits.

**Step 6: Complete the Tax Forms**

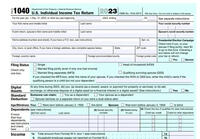

Using the information you've gathered, complete the appropriate tax forms. The main form for individual income tax returns is Form 1040. Depending on your sources of income and deductions, you may also need to complete additional schedules and forms.

**Step 7: Double-Check Your Work**

Before submitting your tax return, take the time to review it carefully for accuracy. Check that all numbers are entered correctly and that you haven't overlooked any deductions or credits.

**Step 8: Submit Your Return**

Once you're confident that your tax return is accurate, it's time to submit it to the IRS. If you're filing electronically, follow the instructions provided by your chosen tax preparation software or the IRS Free File program. If you're filing by mail, make sure to include any required forms and documentation and send your return to the appropriate address.

**Step 9: Pay Any Remaining Tax**

If you owe additional tax after completing your return, you'll need to submit payment to the IRS by the tax filing deadline. You can pay electronically using IRS Direct Pay, a credit or debit card, or by mailing a check or money order.

**Step 10: Keep Copies of Your Tax Return**

Finally, make sure to keep copies of your completed tax return and any supporting documentation for your records. These documents may be useful for future reference or in case of an audit.

By following these steps and staying organized throughout the process, you can successfully file your own federal income tax return with confidence. Remember to start early, gather all necessary documents, and double-check your work to ensure accuracy. If you have any questions or need assistance, don't hesitate to consult the IRS website or seek guidance from a tax professional.

Mind Detour offers humorous, educational and interesting articles and videos to detour your mind from the everyday grind.

Be sure to follow us on Twitter and like our page on Facebook.

Thank You for visiting my site, I really appreciate it! Please do me a huge favor and share my articles with your friends on social media.